Welcome to McCallie on Money, a resource for understanding how money works beneath the surface. Here, we explore the ideas outlined in Professor John McCallie’s paper, “The Derivatives of Money: The ‘House Money’ of Banks,” which provides a fresh, market-oriented framework to understand the difference between actual money (“base money”) and its many substitutes—such as bank deposits, digital tokens, gift cards, or even cryptocurrencies—and how these inventive substitutes for money, while not money in a formal sense, greatly facilitate trade and finance in a modern economy by acting as claims on what is actual money.

Money and its substitutes are not mystical creations wielded solely by central banks. Instead, their value and supply are disciplined by competitive markets and the relentless force of arbitrage. Actual or real money, referred to here as base money, anchors the system, while substitutes thrive only so long as they are credibly tied to the “anchor” of base money. By viewing money through this lens, we can better appreciate how innovations in technology, clearing systems, and trust mechanisms offer the possibility of a sound and vibrant monetary system that is more market oriented and decentralized. For those skeptical of the Federal Reserve’s power in an age of rapid financial evolution, such decentralized possibilities can reduce our reliance on centralized or monopolistic control over monetary affairs.

A key insight of McCallie’s work is that money substitutes—such as bank deposits or digital tokens—derive their legitimacy not from arbitrary state power but from market activity and well-defined legal agreements. The ability of individuals and institutions to create, accept, and enforce these financial instruments rests on the sanctity of contracts and the expectation that property rights will be upheld. Without this foundation, confidence in money—whether physical cash, bank credit, or stablecoins—collapses.

Key Ideas You’ll Find Here:

- Base Money vs. Money Substitutes:

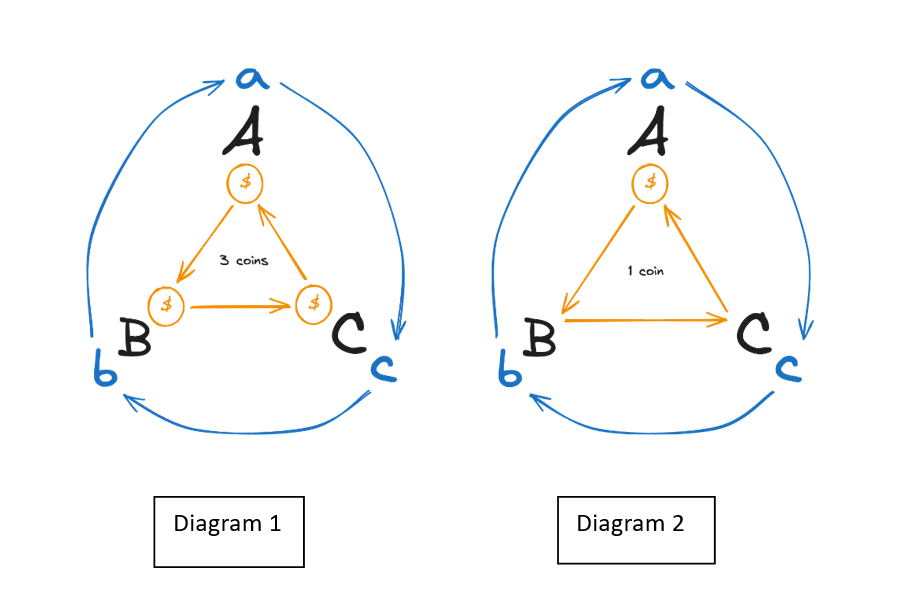

Understand why demand deposits, traveler’s checks, digital tokens, and other negotiable or tradable credit instruments perform like “chips” in a grand “casino” of commerce, being always anchored to cash or base money with their cash-out-at-will feature. - The Anchoring Role of Arbitrage:

See how the strong competitive forces of the market keep money substitutes aligned with the objective value of base money, ensuring price levels remain tethered to real economic fundamentals rather than top-down directives. - Economizing on the Use of Money:

Discover how the “market of concurrent trading” allows us to consummate a multitude of daily transactions without the necessity of money exchanging hands—improving efficiency through coordination, trust, and technology, rather than constant central bank intervention. - Interest Rates and Capital Formation:

Explore how the innovations of money substitutes create a novel means of exploiting savings and how real interest rates emerge from genuine saving and investment patterns—rather than being imposed arbitrarily—where “data-dependent,” discretionary policy can distort market rates and destabilize financial conditions. - Implications for a Changing World:

Consider the implications of technological innovation, digital currencies, AI-driven payment platforms, and evolving global financial landscapes, how might these factors reshape our understanding of who truly holds the reins of monetary influence?

What You’ll Find on This Website:

- The Original Paper:

Dive into the full text of “The Derivatives of Money: The ‘House Money’ of Banks“ for a rigorous explanation of the theory and historical insights. Includes the “McCallieBot” ready and able to answer any questions you may have. - Mathematical Framework:

Details the mathematical underpinnings of the model—complete with equations, graphical representations, and hypothetical scenarios. - Conversations with Thinkers Past and Present:

Explore AI-driven dialogues where Professor McCallie “interviews” influential economists and historical figures to test and expand these ideas. Learn how von Mises or Friedman might respond, or see how a modern crypto entrepreneur would engage with these classical concepts. - Further Readings and Case Studies:

Find curated reading lists, historical examples, comparisons to other schools of thought (like Austrian economics or Modern Monetary Theory), and case studies on free-banking eras, currency boards, and more. - Intelligent Assistance at Every Turn:

On every page, you’ll find a chatbot powered by OpenAI. This academic assistant can help clarify concepts, point you to relevant sections of the paper, or explain a historical example—giving you a personalized, interactive learning experience.

Who This Is For:

McCallie on Money caters to the intelligent layperson intrigued by how money actually works, as well as to professional economists or policymakers who question whether central banks hold as much sway as commonly assumed. It’s especially designed for those asking questions about the Federal Reserve’s power, curious about alternatives, and open to seeing how innovations like stablecoins and digital clearing platforms might shift the monetary landscape even further away from central control.

Ready to rethink what underpins our monetary system?

- Read the Original Paper for a clear conceptual understanding and theoretical implications.

- Engage with the Chatbot to dive deeper into specifics.

- Explore Our Conversations and Frameworks to see these ideas applied in various contexts.

Join us on this journey as we rediscover money not as a top-down creation, but as an evolving, market-driven phenomenon poised to shape the future of finance.